Flight to Economy and Efficiency - Market Insight Q2 2017

There is popular notion of "flight to quality" whereby consumers, or occupiers in the case of real estate, would prefer better and in most cases newer options. Quality alternative usually equates to higher cost. With the real estate boom in recent years, brand new and quality options for office, residential, malls, hotels and industrial spaces are abound. Quality of these options has been pretty much standardized, with minimal upgrades or downgrades offered by the developers that can be discerned by the consumers. With quality being almost equal, occupiers are now looking for more economic and efficient options.

In the case of President Rodrigo Duterte, there is also a big focus on the economy and infrastructure spending, even with the continued war on illegal drugs and the recent Martial Law in Mindanao. More importantly, these infrastructure developments are spread all over the country that would boost the countryside. The National Economic and Development Authority (NEDA) Board’s Investment Coordination Committee (ICC) has approved Php 541.58 billion worth of rail and other infrastructure projects.

These projects are: (1) Mindanao Railway Project (MRP) Tagum-Davao-Digos (MRP-TDD) segment with a construction target starting on the first quarter of 2018; (2) Cavite Industrial Area Flood Risk Management Project that aims to mitigate flooding of 45,000 homes ; (3) North South Railway Projects (NSRP) - South Line, which will revive the Philippine National Railways (PNR) south railway, consisting of three tracks that will run from Tutuban to Los Baños for the commuter line (72 kms), and Los Baños to Sorsogon for the long haul (581 kms), terminating at the Port of Manila; and (4) Malolos-Clark Railway Project (MCRP) which will be connected to the ongoing Tutuban-Malolos portion of the North South Commuter Railway. The MCRP will run from Malolos, Bulacan, to Clark International Airport (Phase I), and from Clark International Airport to Clark Green City (Phase II). The construction for Phase I will begin on the second quarter of 2019.

Moreover, the ICC also approved a two-year extension of the OPEC Fund for International Development loan for the Road Improvement and Institutional Development Project of the Department of Public Works and Highways (DPWH), which include noted updates on the ongoing review of various roads and bridges, public transport, irrigation, and flood control projects. The DPWH is set to start next year the construction of the Php 50-billion, 74-kilometer Metro Cebu Expressway, an integrated seamless transport system that would decongest major thoroughfares. This project will reduce travel time from Naga City to Danao City from three hours to just one hour and 25 minutes.

The DPWH recently broke ground for the BGC-Ortigas Center Link Road Project that includes a four-lane bridge across the Pasig River connecting Sta. Monica Street in Pasig City and Lawton Avenue in Makati City, as well as a viaduct traversing Lawton Avenue to the entrance of BGC. Furthermore, the Department of Transportation and Light Rail Transit Authority will lead the groundbreaking ceremony of the LRT Line 2 East Extension that will signal the start of construction of two additional stations, Masinag and Emerald. The LRT 2 is originally a 13.8-kilometer mass-transit line that traverses five cities in Metro Manila namely Pasig, Marikina, Quezon City, San Juan, and Manila, along the major thoroughfares of Marcos Highway, Aurora Boulevard, Ramon Magsaysay Boulevard, Legarda, and Recto Avenues.

The Philippine economy will surely benefit from this major infrastructure spending, and would improve the efficiency of transportation and doing business since majority of these projects are rail development projects. There is a theory that no country has industrialized without an efficient railroad system. It appears that these projects will sustain the steady upward flight of the economy.

MACROECONOMY

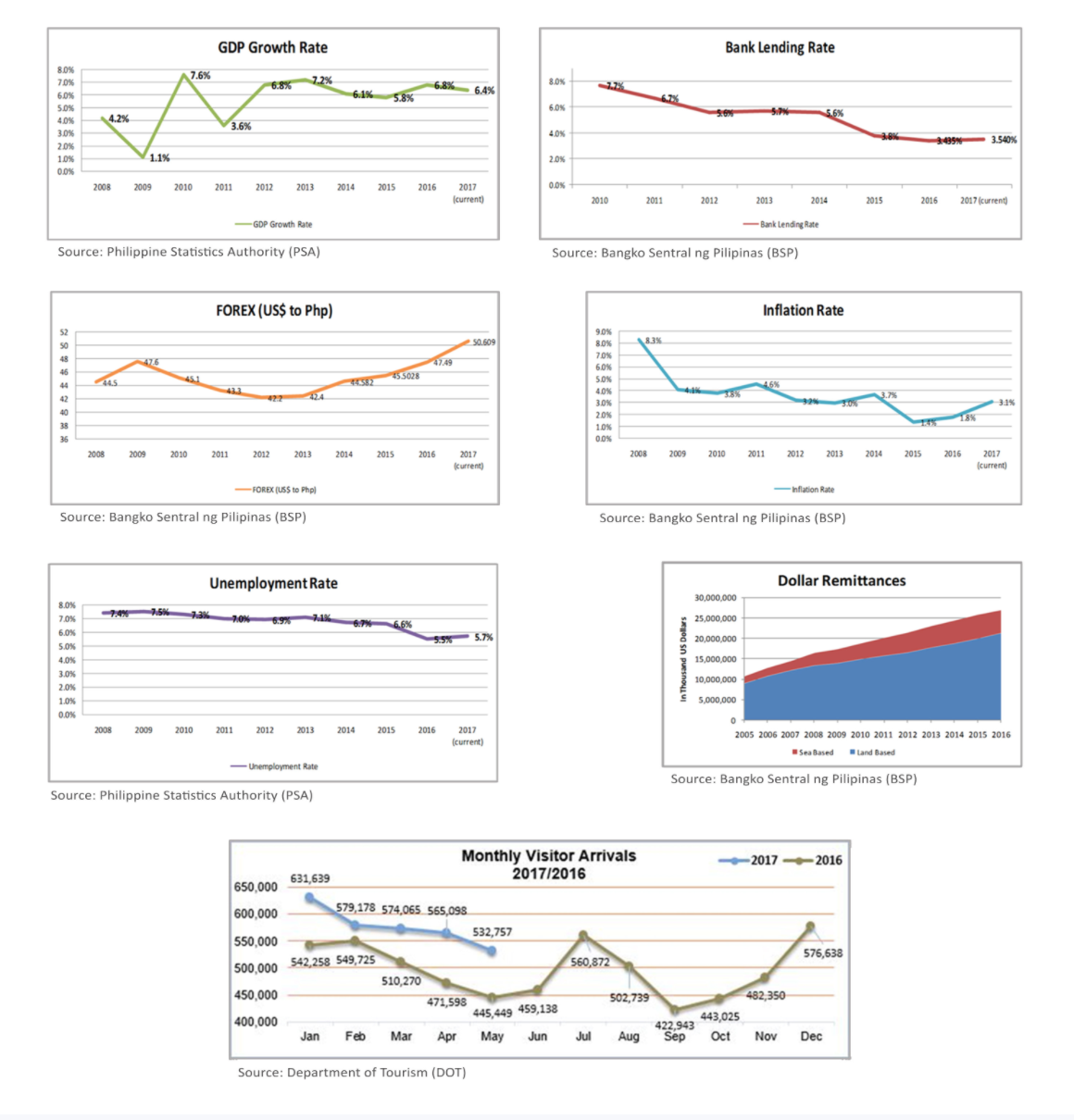

The Philippine gross domestic product (GDP) grew by 6.4% during the first quarter, which is slightly lower than the 6.8% growth for the entire 2016. National Economic and Development Authority (NEDA) is projecting 7% growth, and the annual target is pegged between 6.5-7.5%.

The Bangko Sentral ng Pilipinas (BSP) figures show that the net foreign direct investment (FDI) from January to April of this year reached US$ 2.434 billion, which is slightly lower for the same period in 2016. At any rate, this is still at pace to breach again the US$ 7 billion-mark that was done for the first time last year. This total does not include investments by the Business Process Outsourcing (BPO) companies.

Based on latest BSP statistics, the average bank lending rate from July 3 to 7, 2017 slightly increased to 3.5396% as compared to 3.4351% towards the end of 2016. This is still a very attractive rate even with the slight uptick. The Philippine Peso to US Dollar exchange increased to Php 50.609 to a dollar as compared to the 2016-average of Php 47.4925. This is a clear sign that the US economy has stabilized after some years of uncertainty, especially with the financial crunch starting in 2008 and a number of limited armed conflicts. Nevertheless, the depreciating peso is not necessarily a bad thing, since Filipino products, especially real properties, would be more attractive to dollar-earners, and probably to other foreign currency earners. The most crucial import that needs to be monitored is the price of gasoline. When gasoline price peaked at Php 60-to-a-liter of premium gasoline at the height of the Middle East wars, the GPD growth dipped to only 3.6% in 2011. Increasing oil prices has profound impact to the cost of transportation, logistics and power generation, and ultimately, to the economy. Thus, Pinnacle Research is in the view that bank interest rates and foreign exchange are stable and manageable at present.

Overseas Filipino remittances continue to grow. Total remittances from January to May 2017 reached the US$ 11.35 billion as compared to US$10.86 billion for the same period in 2016, or an increase of 4.5%. At this pace, remittances are on track to breach the US$ 27 billion-mark this year.

The headline inflation rate from January to June 2017 increased to 3.1% as compared to the annual average of 1.8% in 2016. This increase in inflation rate is a clear sign that the government, businesses and consumers are now spending more, and this would in turn lead to economic growth. BSP's target inflation for 2017 ranges from 2% to 4%.

Based on Department of Tourism statistics, the total visitor arrivals from January to May 2017 reached 2.88 million from 2.52 million for the same period last year. There is a significant increase of 14.43% between the two periods. Most are hopeful that the increase may offset the negative publicity generated by the Martial Law in Mindanao, and that the target of six million arrivals by end of the year will be reached.

The latest unemployment rate released by PSA is at 5.8% as of the April 2017 survey. This is slightly higher than the 2016 unemployment rate of 5.5%, but still below the nominal average of 6.6% in the past five years. While there is fluctuation, business activities have been absorbing the ever-increasing number of graduates per year.

The Philippine economy is still very robust as evidenced by these macroeconomic indicators. While the Peso weakening versus the dollar and inflation rate is slightly increasing, it can be inferred that Philippine products are more affordable, and that there is more spending coming from the consumers, investors as well as from the government. President Rodrigo Duterte's administration has been embarking on massive infrastructure development. Considering all of these, the flight of the Philippine economy is steady and upward.

ECONOMY, EFFICIENCY AND ECONOMY OF SCALE

As earlier reported, the Ayala Land Group will launch approximately Php 100 billion worth of projects this year, or an increase of 64% from 2016. Morevoer, the Alveo brand will launch Php 40 billion worth of inventory consisting of 16 new projects, which would effectively dislodge the Ayala Land Premier brand as the "Group's crown jewel." Alveo projects have high quality finish, but their prices are not yet considered luxury high-end like the Ayala Land Premier brand. Based on reports, Ayala Land Inc. has a market capitalization of Php 608.14 billion, only second to the SM Group.

SM Prime Holdings Inc. recently became the first Philippine company to reach Php 1 trillion in market capitalization, according to newspaper reports. Megaworld Corporation comes in at third, with Php 146.36 billion in market capitalization.

By the end of the year, the SM Group will have 65 malls in the Philippines and seven malls in China with an estimated combined gross floor area of 9.2 million square meters. In the Philippines, 43% of its malls are located in Metro Manila, 35% in Luzon outside Metro Manila, 14% in the Visayas and 8% in Mindanao. In terms of residential development, SM Group will launch between 15,000 and 18,000 residential units this year. The Group even plans to start with the pre-selling of its housing project located next to its mall in Chengdu, Sichuan Province, China by end of 2017.

The Megaworld Group is said to be the biggest lessor of office spaces and urban township developer. The Group's sustained double-digit growth has been attributed to stronger rental revenues that soared to Php 10.01-billion in 2016, as well as to the Megaworld Group’s efficient cost management in operations. The Megaworld Group will be developing a Php 30-billion 35.6-hectare township in San Fernando, Pampanga over the next 10 years. Dubbed as "The Capital Town," it is the Group's first integrated project in Central Luzon. The Capital Town is envisioned to serve as Pampanga’s central business district with residential towers, office buildings, a mall, retail hubs, school, ampitheater, and events venues.

Vista Land Group recently increased its target offering to the property market from Php 30 billion to Php 42 billion worth of real estate projects this year, due to stronger-than-expected market demand. For the first quarter alone, the Group launched projects worth Php 12 billion. Vista Land Group has land bank in 117 areas all over the country, with a presence in 140 localities.

Robinsons Land Group intends to grow its revenues from malls and offices as well as residential sales. Apart from the new malls in Cebu City, Tagum in Davao, General Trias in Cavite, and Jaro in Iloilo, it recently carved a market in Naga City in Bicol. The mixed-use development is located at the corner of Naga Diversion Road and Almeda Highway and will feature a shopping mall, an office building, and two hotel chains: Go Hotels and Summit Hotel.

Robinsons Group considers Naga an ideal location for BPO locators on the back of strong government and private sector support, backed by a highly proficient labor pool given the presence of several major universities such as Ateneo de Naga and University of Nueva Caceres. The office building is registered with the Philippine Economic Zone Authority (PEZA) as an IT Center.

Filinvest Land Group recently started the construction of "One Filinvest," a 34-storey tower that will replace the former Philcomcen building in Ortigas. This property was acquired from the Government Service Insurance System (GSIS) asset disposal program. This will be the Group’s first office development in Ortigas central business district.

The Group has been embarking to increase its landbank outside Metro Manila. The Group together with its parent company Filinvest Development Corp. (FDC) have signed a lease agreement with Clark Development Corp. (CDC) to develop, manage and operate the 200-hectare Clark Mimosa estate for a term of 50 years, renewable for another 25 years; and it agreed to do a joint venture development of the 288-hectare Clark Green City.

The top developers have been leveraging their sizes to achieve an economy of scale. While most of them would be offering attractive rents and prices for their products, one of their eyes would be watching on the quality of their offerings. Buyers and tenants will remember unpleasant turnover conditions. In addition, efficiency of operations and maintenance are likewise viewed highly by occupiers.

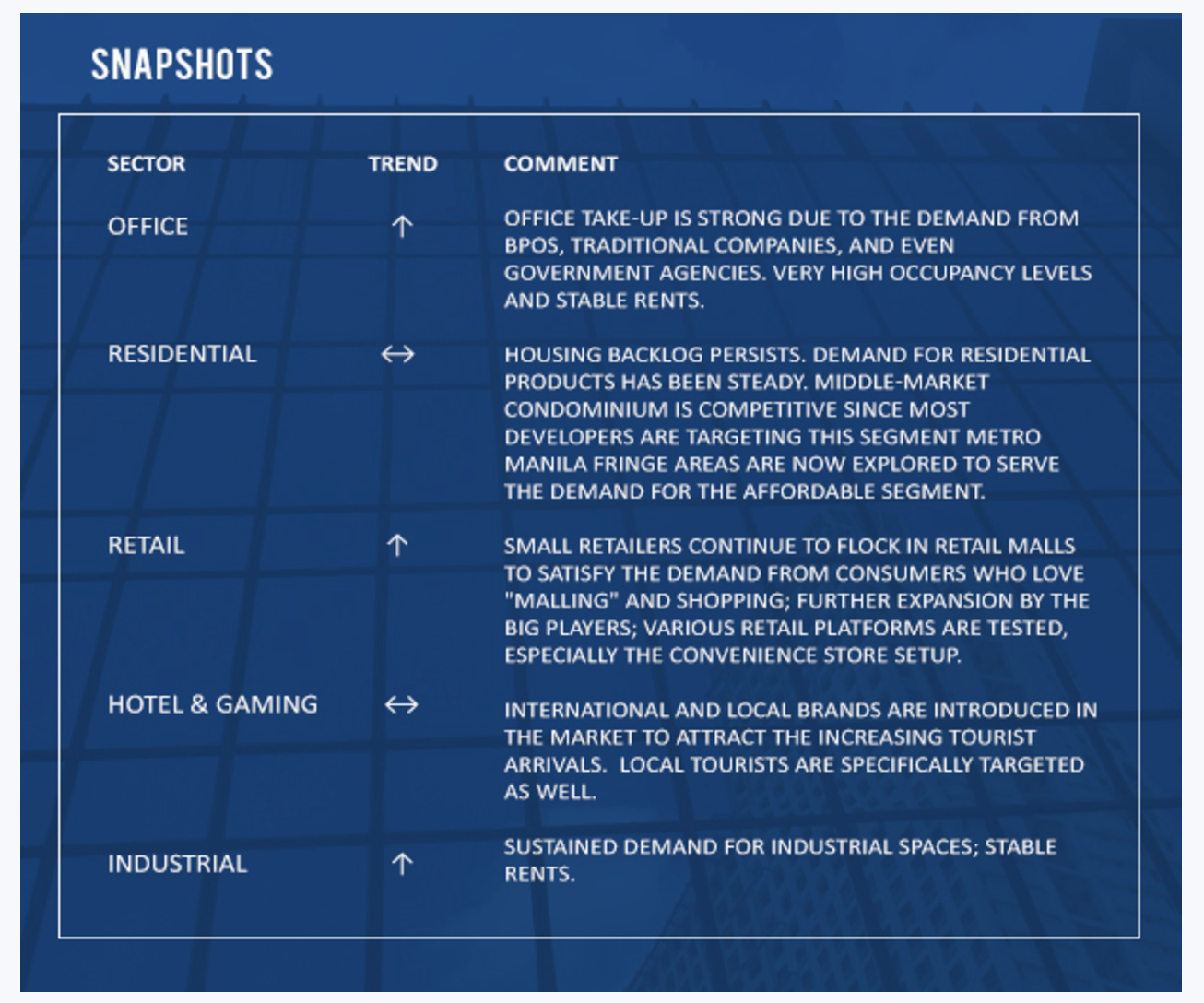

OFFICE MARKET

The Office Market in Metro Manila as monitored by Pinnacle Research reached 8.6 million square meters of Grade A office building or better (handful of Prime Grade A buildings in Makati CBD) due to the new buildings that came online. Overall vacancy across the various business districts slightly increased to 3% as new buildings are being absorbed by the market. It is important to note that most of the buildings that opened were pre-leased, with limited office space available for lease.

While the office market is still a landlord's market due to high occupancy, rents have stabilized with miniscule upward bias. The Bonifacio Global City (BGC) and Makati CBDs are still the preferred location of BPOs, but for their secondary offices and expansions, BPO companies would not mind going to other CBDs for the lower rent. Going to other CBDs would also mean tapping to another labor market, which is key in the BPO sector. Rents in Makati Central Business District (CBD) are stable, where Premium Grade A buildings have a weighted average of Php 1,400 per sqm per month, Grade A buildings have a weighted average rent of Php 950 per sqm per month, and for Grade B&C Buildings, the weighted average is Php 720 per sqm per month.

The weighted average rent in BGC is at par with Makati Grade A buildings at Php 950 per sqm per month. The average rent of Grade A office buildings in Ortigas, Alabang and Bay Area is estimated at Php 680 per sqm per month. Quezon City office rents have a slightly higher weighted average of Php 700 per sqm per month, owing to newer and fewer buildings. Ortigas and Alabang averages are weighed down by older buildings.

RESIDENTIAL MARKET

According to the Bangko Sentral ng Pilipinas (BSP), Philippine residential property values grew 1.1% in the first quarter of 2017 from a year earlier. The Residential Real Estate Price Index (RREPI) rose to 117.2 in the January to March period this year from 115.9 in the same quarter in 2016. The base period of the index, or the time when it was "100" is the first quarter of 2014. Based on this index, residential property prices grew by 17.2% since the first quarter of 2014. While the increase is substantial, the slight increase from the first quarter of 2016 means that prices are "plateauing."

Nonetheless, the big players are still building due to the huge housing backlog. Approximately, half of the six million with housing needs "Can Afford to Buy."

Pinnacle Research estimates that the Metro Manila residential condominium projects would reach a total of 240,000 units by the end of 2017. Small and medium players are also waiting for the approval of the implementing rules and regulations as well as the price ceiling for vertical socialized projects.

The BSP also reported in terms of total loans released by universal and commercial banks to the real estate sector. Based on the latest figures, a total of Php 1.31 trillion loans were extended to borrowers by the end of the first quarter of this year, or an increase of 21.5% for the same period last year. Again, this substantial increase shows that there are more people buying, and they are being financed by the banks.

RETAIL MARKET

SM Prime is the undisputed leader in the commercial retail arena. It is currently operating 60 big malls nationwide, with a goal to penetrate more cities and towns. By year-end, SM Prime will have 65 malls in the Philippines, and these five new malls are outside of Metro Manila. These malls are scheduled to open soon: (1) SM CDO Downtown Premier in Cagayan de Oro; (2) SM Cherry Antipolo in Rizal; (3) SM Center Tuguegarao Downtown in Cagayan; (4) SM City Puerto Princesa in Palawan; and (5) SM Center Lemery in Batangas. Moreover, SM Group intends to increase its malls to 75 by 2018.

SM Retail also operates 48 supermarkets, 44 hypermarkets, 156 Savemore grocery stores, 39 Waltermart stores, 210 Alfamart convenience stores and 1,749 specialty stores. The Group intends to expand its Alfamart platform to 500 stores by next year.

To address the emergence of e-commerce, which may affect malls' foot traffic like with what is happening in the US, the SM group has taken steps like a partnership with online platform Lazada to sell products on SM stores, and the acquisition of a 34.5% stake in 2GO's parent company.

Meanwhile, Cosco/Puregold Group has also been busy with its own acquisitions apart from operating a total of 329 stores nationwide comprising of 277 Puregold stores (mixed sizes), 12 S&R membership shopping warehouses, 23 S&R New York Style QSRs, nine NE Bodega Supermarkets, and eight Budgetlane Supermarkets. It recently acquired the famous Office Warehouse, and even Liquigaz, which is a big player in liquefied petroleum gas (LPG) distribution.

Other players like the Vista, Robinsons and Ayala Groups have been tinkering with various small retail platforms as well. While the blended average rent for commercial-mall space has been steady at Php 1,200 per square meter per month, some mall spaces in some crowded areas are observed.

HOTEL AND GAMING MARKET

The top developers have been busy gearing up their local brands. The Robinsons Land Group has been expanding its Go Hotel operations to 16 hotels, and is looking to duplicate its successful Summit Hotel in its Robinsons Magnolia development. Ayala Land Group has rolled out six Seda Hotels. The Vista Land Group is building four hotels under the Mella Brand to add to its current operation of the Boracay Sands Hotel. The second tier Eurotower Group has ramped up its operations to nine Eurotel branches and 39 Sogo branches.

In terms of high-end products, Pinnacle Research estimates that there are more than 20,000 deluxe hotel rooms in Metro Manila. The big players have been partnering with international brands to deliver luxury rooms in the market.

The tourism target is still at six million arrivals this year. To its credit, the national and even a number of local governments have been busy attracting to host international events to increase the volume as well as the spending of tourists. With the recent travels of President Duterte, his administration has been attracting Mainland Chinese as well as Russian tourists and investors.

INDUSTRIAL MARKET

The list of economic zones as reported in the Philippine Economic Zone Authority (PEZA) website remains unchanged as of the writing of this Market Insight from Pinnacle's 2017 First Quarter report. The operating economic zones are: 73 Manufacturing Economic Zones, 243 Information Technology Parks/Centers, 21 Agro-Industrial Economic Zones, 19 Tourism Economic Zones, and two Medical Tourism Parks/Centers, or a total of 358 economic zones. There are no changes in the number of economic zones being developed: 29 Manufacturing Economic Zones, 104 Information Technology Parks/Centers, six Agro-Industrial Economic Zones, and six Tourism Economic Zones, or a total of 145 economic zones being developed. Since industrial spaces are typically sprawling, average lease on land of selected zones ranges between Php 55-70 per sqm per month, while average lease of selected factory spaces ranges from Php 150 to Php 250 per sqm per month, depending on the level of fit out of the industrial spaces.

FLYING HIGH FUELLED BY STRONG DEMAND

The real estate developers have been aggressively capturing the demand of the buyers and renters in the past years, and they are not stopping. The big players have been innovating and blending their product offerings to maximize their margins in every location to put a flag on.

Pinnacle Research expects this steady flight to continue, although this continued growth should be taken with a grain of salt. Consumers are looking for high quality products for the most attractive rates. Extra diligence should be put into new products to avoid compressing margins later on due to competition. Most people love flying, and flying in economy class, especially those purchased very early are quite popular among Filipinos. Philippine real estate market will experience this "flight to economy" without sacrificing quality in the coming months.