WSJ Luxury Real Estate Study

The Wall Street Journal surveyed 1,306 home owners in the luxury real estate market for 2018 and here’s what they found.

In the fall of 2018, The Wall Street Journal surveyed its print and digital readers, gaining insight to their previous luxury real estate purchases and future plans regarding the marketplace with the goal of understanding the drivers behind home purchase decisions, future plans, and impressions the luxury real estate marketplace.

Respondents are scattered throughout the Northeast, South, Midwest, and West, and vary in household income and household net worth. The participants reported an average household income of roughly $300,000 and present the habits and thoughts of distinctive homebuyers - those who are considering not only the financial implications of a luxury real estate purchase, but also trending lifestyle associated with geographical location.

At 89%, the vast majority of participants own real estate, most being their primary residence. While the average principle home value across the nation is $1,100,000, the average value varies in each market. Leading the pack with the highest average home value is San Francisco at $2.9M, followed closely by Los Angeles at $2.4M.

While the majority of participants solely own their primary residence, almost 40% also own at least one more home. Results show that secondary homes are being used as both vacation homes and investment opportunities. The number of participants who use their secondary home as an investment/rental property is almost equal to those who use it as a weekend or vacation home. However, interest in investment or rental properties is significantly more common among Gen X than among Boomers.

Looking to the future, participants were also asked about their real estate purchase intent. Nearly half stated that they plan to make a real estate purchase - either primary or secondary - in the next 5 years. At 9% more than the average primary residence value, the average projected budget for participants’ next home purchase is $1,225,554.

While the majority expect to pay more for their primary residence in the coming years, the majority of respondents plan to pay less than the nation-wide average for their next secondary or investment properties. When it comes to paying for the home, respondents are nearly as likely to plan to pay all cash than to finance.

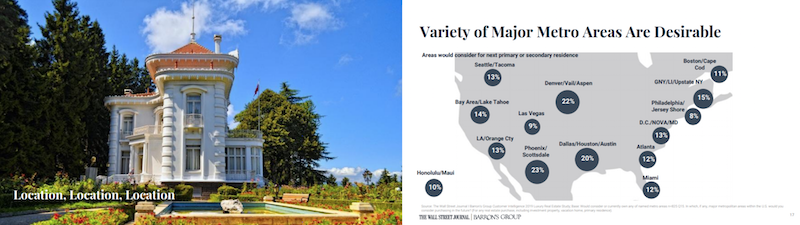

When it comes to real estate, it’s all about location. Nearly half of respondents would consider moving beyond their local market for their next purchase. However, most do not intend to go far. The average distance of participants’ next move is just shy of 300 miles.

Many of the hot markets among participants are located in the South and the West, with over 75% stating that they intend to move to those areas. A variety of major metro areas have proven to be desirable. The most popular migration destinations are Phoenix/Scottsdale, Denver/Vail/Aspen, and Dallas/Houston/Austin, with a combined 65% of participants showing interest in moving to these areas. In addition, 2 in 5 respondents would consider purchasing outside the continental US. The majority of those are most likely to do so in Western, Central, or Eastern Europe.

To read the study in its entirety, click here to download.

The property seen above is represented by Westside Estate Agency.

- Topics:

- Voice from the Street

- Ultra Lux

- Technology

- Arts & Culture