Vanguard Properties: Q1 2016 Marin Market Update

Learn the latest real estate news from Vanguard Properties, who recently released their first quarter market report of 2016, with statistics and analysis covering Marin County, California.

We love the spring selling season. Excitement about new listings, the surprises of what goes into escrow immediately and what sits on the market. What's around the corner, and will there be more? Yes, of course there will, but let’s not count on a huge influx of inventory. Inventory has always been scarce in Marin, so a word of advice… if you're out shopping and you see something you like, grab it!

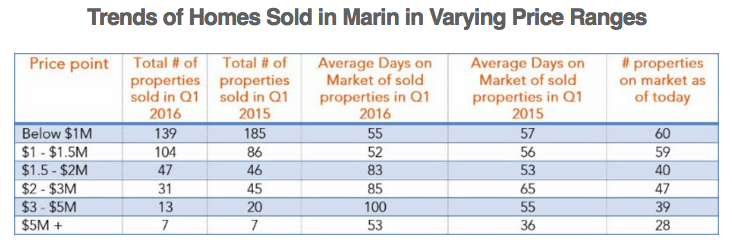

The topics du jour amongst my colleagues is "are buyers willing to pay more?", “how high will they go?” Or, "have they hit their limit?” The answer to everything, obviously, is "it depends." The under $1 million market is white hot, with 139 properties selling thus far in the first quarter of 2016. We can even say the same about the market up to about $1.5 million. That seems to be the point where buyers become a bit more selective with the “days on market” increasing. Not slow, per se, but buyers are more willing to kick the tires a bit to make sure the value is there and that they're not overpaying.

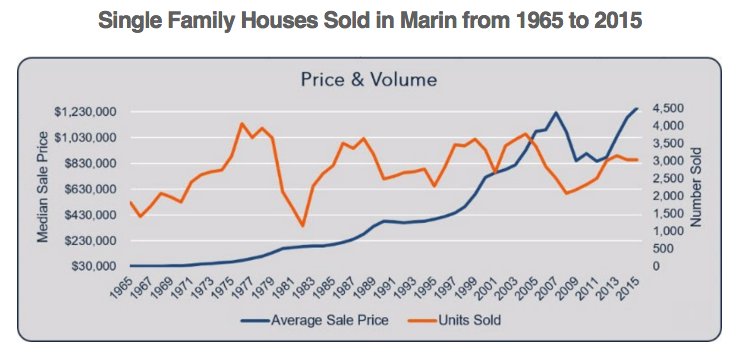

Yes, price increases can be a bit frightening. Any time home prices hit new highs there is a fear that it's all going to come crashing down. But, if you look at historical figures, that's just not the case. Housing prices in Marin have continued to rise over the years, as we can see from the graph below. Sure, we've had dips and surges of activity based on extreme market forces and supply and demand, but invariably housing prices continue to rise. Marin has perhaps increased at a more modest rate than San Francisco and the Peninsula, but still prices have risen. The first quarter of 2016 was no exception.

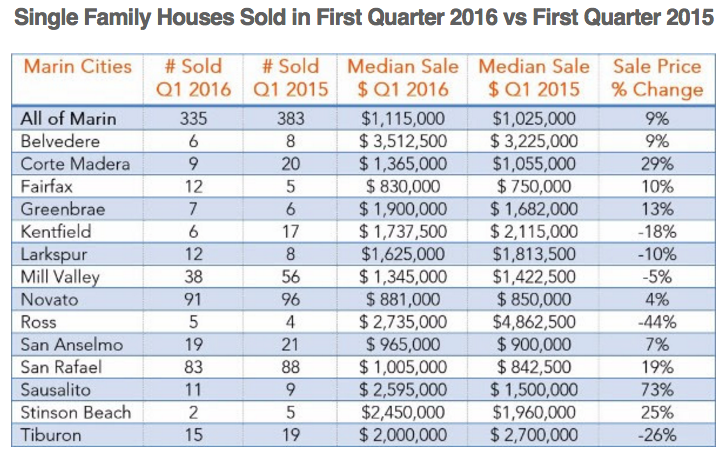

Overall, the first quarter of 2016 showed a median single family home sales price increase of 9% compared to quarter one of last year – from $1,025,000 to $1,115,000 – while the number of sales declined by 13%.

On the other end of the spectrum, single family homes in Belvedere, Fairfax, Greenbrae, San Anselmo, and Stinson Beach have seen median home price appreciation north of 7% quarter-over-quarter. Sausalito had significant price appreciation at 73% though the sample size of homes is still relatively small. Corte Madera’s growth shows a dramatic 29% price increase, but only half the number of homes sold compared with quarter one of last year. San Rafael maintained its large number of homes sold from the previous year’s first quarter, where we see healthy price appreciation at 19%. Novato, on the other hand, sold 90+ homes in the first quarter but price growth only rose 4% compared with the same period last year.

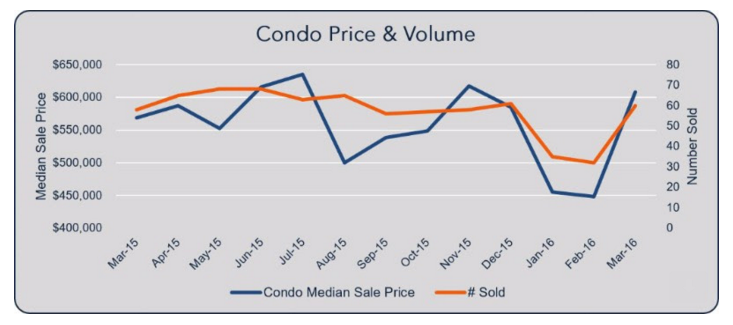

As of this writing, there are currently 269 single family homes and 75 condominiums on the market in Marin (344 combined). In the first quarter we saw a minor decrease in inventory (383 sold in Q1 2015, versus 335 in 2016) and a 4.5% price increase in homes sold in Marin (single family and condominiums combined).

Marin remains a coveted place to call home with a plethora of financially capable buyers seeking homes. When a property with obvious value hits the market, it's a no-brainer for buyers. When a more complex property comes on – maybe not as many comps, a unique home with unique attributes, etc. – it takes buyers a little longer to ponder. Not a bad thing, they're just taking it all in. Of course, as in any market, overpriced homes won’t garner the same attention, and may continue to sit until they eventually sell for less or they’re taken off the market.

In the luxury market, properties in the $3-5 million range are averaging 100 days on market (twice as long as last year), while properties over $5 million are sitting for half that time. As could be assumed, inventory in the $3-5 million range was markedly less this quarter compared to the first quarter of 2015. However, homes sold over $5 million was at exactly the same number.

Buyers are getting more judicious in their search, looking for the perfect home. As a result, they are willing to wait for that right home to come on-market before placing any offers.

Last October CAR predicted a more modest overall increase in housing prices for 2016, which has been evident thus far. Can we expect them to stabilize or decrease? Conventional wisdom says yes, because as we've mentioned before this is a cyclical business; there will always be fluctuations. However, buying for the long-term in Marin could never be a more sound investment, especially in the land of Mt. Tam, our beautiful Bay and a quality of life that is unmatched anywhere! According to CoreLogic, San Francisco's housing market may actually be undervalued, so the seemingly high prices in Marin may continue to rise.

The local economy continues to prosper, with recent unemployment figures clocking in at 3.3% for the Bay Area. The Wall Street Journal recently reported that US Venture Funds have collected about $13 billion in the first quarter, the largest total since 2000. It is anticipated that there will be a number of technology IPOs this year, depending on stock market volatility, and that always has a trickle-down effect for Marin and the rest of the Bay Area.

While "all cash" purchases still exist, many buyers want to conserve their cash, meaning more and more buyers are utilizing a mortgage as part of their home purchase offering. We are seeing lots of bridge financing for buyers so they can make a solid offer on a home without first selling the one they live in. Some buyers are also getting hard-money loans for the purchase and then writing "all cash" offers only to refinance once they become owners. They are doing what is necessary to make their offers as competitive as possible and this sometimes includes up-front inspections or even, though not recommended, non-contingent offers (meaning buyers will take the house "as is" without inspections or without thoroughly investigating the property).

If you're thinking about selling your property we recommend getting a pest and even a contractor's inspection ahead of time. Providing buyers with as much information about the house upfront will allow them to place an offer based on the knowledge you've provided without having to guess. It's just a better approach overall than risking a potential non-disclosure issue down the road.

Of course, whether buying or selling, I'm here to provide you with expert advice on the best approach to your individual situation. Feel free to call me to provide an analysis on what your home might be worth in this market, or to see the most current inventory.